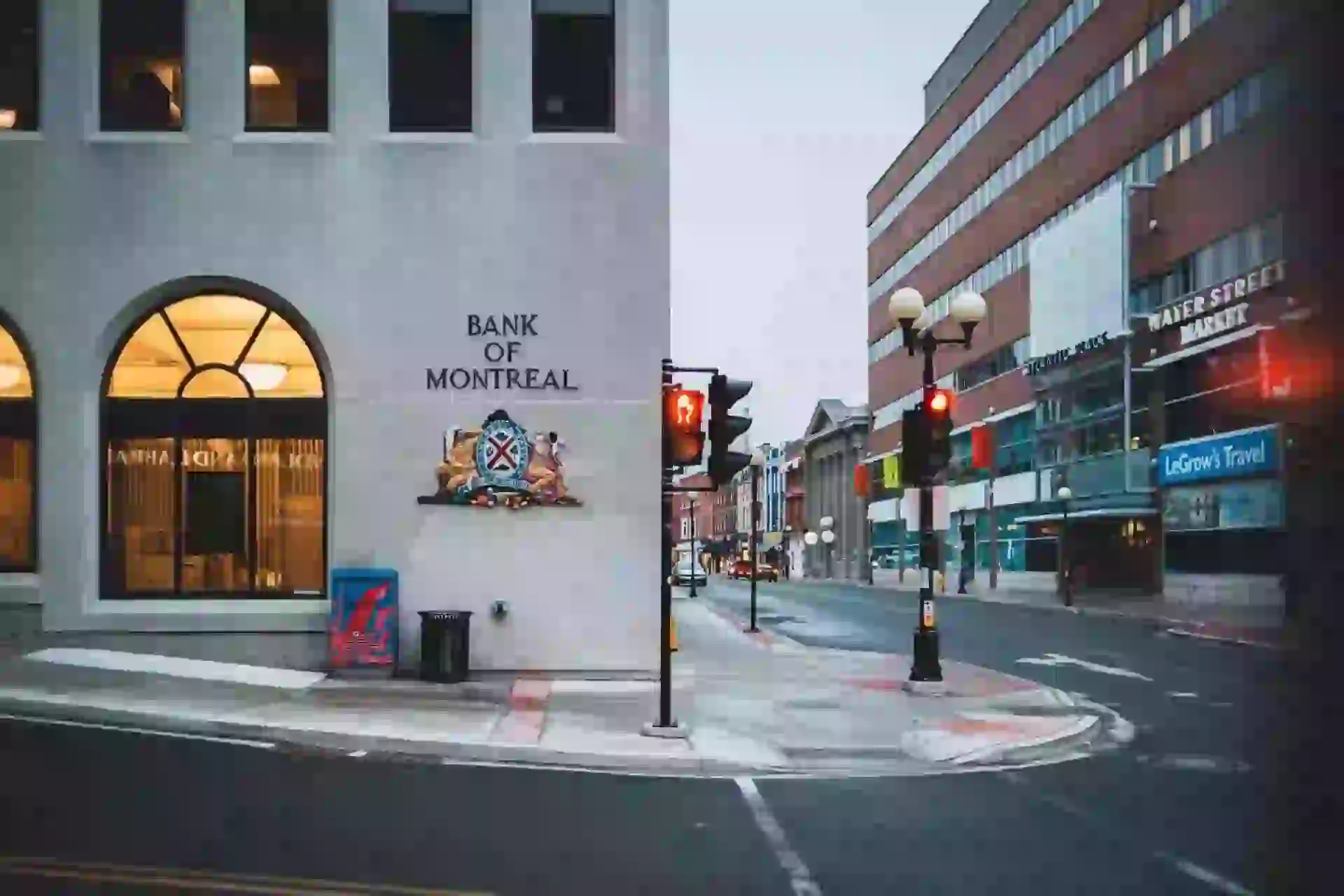

Among the industries that are misunderstood is banking. People don’t understand that banks are owned by people, and most people view them as utilities (electric, gas, banking). There are some publicly traded banks in America, especially the large national banks, but most are privately owned. Currently, I own OneUnited Bank, America’s largest Black-owned bank. But I was still incredulous when I first saw the opportunity 20 years ago, some 20 years after I graduated from Harvard Business School and worked in financial services for seven years, including Bank of America and American Express.

Among over 5,500 financial institutions, only 19 Black banks currently operate in America. Across the country, most banks are overwhelmingly owned by white people and most Americans bank with white-owned institutions. In most cases, that’s what happens.

Historically, the American banking system has created systemic and intentional barriers to building wealth for the Black community, such as financing slavery, Jim Crow, and predatory lending. Black banks, on the other hand, are more likely to hire black people and lend to black communities.

#BANKBLACK IS NOT LIMIT to blacks.

What is the process of buying a bank?

- In the first place, you can buy a bank just like any other company. Investments or purchases of assets result in ownership. An investor group can pool their money to make the $50 million investment today.

- Second, a “clean record” and knowledge of banking require regulators.

- Thirdly, you want to manage the bank with a team. Banks for sale must follow extensive banking regulations, balance the need to make money with managing risks (such as credit and fraud risks), and reinvest in communities.

Even though purchasing a bank is a long and difficult process, Blacks should own them.

With #BankBlack, OneUnited Bank demonstrates how communities of color can overcome the financial challenges historically associated with financial institutions. As pride and trust are rebuilt, the world will be a better place. For many of our customers, this is the first time they have experienced joyous banking. Before their relationship with OneUnited Bank, many customers hadn’t done business with other banks.

What is the background of young bankers?

Everybody needs to support us because we serve them all. #BankBlack is not a Black thing. Our customers are our primary allies and are helping us overcome disenfranchisement. During this journey, we seek to promote financial literacy because, at its core, banking should use to build wealth and develop communities, not misunderstood.

What is the cost of opening a bank?

Considering that the banking industry is the most regulated in the country, these costs are significant. A bank typically needs between $12 million and $20 million in capital to start. Perhaps you could raise the money locally if you started a community bank. A solicitation of investors may require otherwise.

In order to apply to regulatory agencies, you must raise capital. In the wake of the financial crisis, regulators are strict in reviewing applications. You can open your bank account once you have approved.

How much does a bank spend on ongoing expenses?

Costs vary on an ongoing basis. In general, however, expenses constitute 15% of non-interest costs, with a median cost per branch of $400,000 across the country.

Check also: 10 Best Tech Startup ideas in 2023

Leave a Reply